1099 div cap gains distributions box 2a where to report Consider capital gain distributions as long-term capital gains no matter how long . Vance Metal Fabricators, an employee owned ISO Certified Company, provides metal fabrication, welding, machined complete weldments and specialized welded components in ferrous and non-ferrous materials to a variety of industries.

0 · irs form 1099 dividends

1 · ireland 1099 dividend

2 · form 1099 div

3 · capital gain distribution form pdf

4 · 1099 dividends explained

5 · 1099 dividend distribution form

6 · 1099 div ireland

Stainless steel inside, joyful color on the outside. Safe steel meal minimal plastic contact. Wont absorb flavours and odours like plastic. Designed and Manufactured in India. Leakproof and .

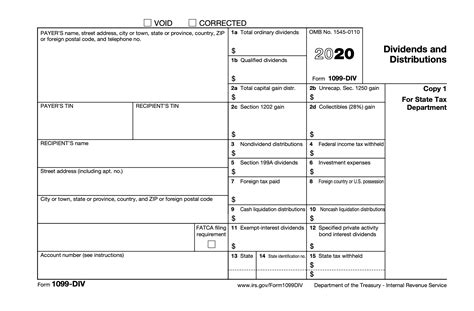

If any part of the ordinary dividend reported in box 1a or capital gain distributions reported in box 2a is attributable to section 897 gains, report that gain in box 2e and box 2f, respectively. See section 897 for the definition of USRPI and the exceptions to the look-through rule.Consider capital gain distributions as long-term capital gains no matter how long .

For the most recent version, go to IRS.gov/Form1099DIV. Section 897 . Capital gain distributions are normally reported to taxpayers on Form 1099-DIV (or an equivalent combined statement from certain brokerage firms). You can enter them into . Consider capital gain distributions as long-term capital gains no matter how long you've owned shares in the mutual fund. Report the amount shown in box 2a of Form 1099-DIV on line 13 of Schedule D (Form 1040), .File with H&R Block to get your max refund. For tax purposes, Form 1099-DIV, Box 2a reports your capital-gain distributions. You could also receive this on a similar statement from the .

For the most recent version, go to IRS.gov/Form1099DIV. Section 897 gain. RICs and REITs should report any section 897 gains on the sale of U.S. real property interests (USRPI) in box .Enter the portion of the dividends in box 1a that qualifies for the reduced capital gains rates. Enter total capital gain distributions (long-term). Include all amounts shown in boxes 2b, 2c, 2d, and 2f. Capital gain distributions occur when fund managers sell individual holdings at a gain. The fund is required to (usually toward year end) pay out those gains to the shareholders. The paid out gains are reported in Box 2a.

Total Capital Gains Distributions from 1099-DIV Box 2a are included as taxable income even though they are reinvested. They add to the cost basis of your mutual fund and .The instructions to Form 1099-DIV explain that they are included in your capital gain distributions on Line 13: Box 2a. Shows total capital gain distributions from a regulated investment .If any part of the ordinary dividend reported in box 1a or capital gain distributions reported in box 2a is attributable to section 897 gains, report that gain in box 2e and box 2f, respectively. See section 897 for the definition of USRPI and the exceptions to the look-through rule. Capital gain distributions are normally reported to taxpayers on Form 1099-DIV (or an equivalent combined statement from certain brokerage firms). You can enter them into TurboTax as follows: Scroll down through All Income and under the section for Interest & Dividends, select Start or Update across from "Dividends on 1099-DIV".

Consider capital gain distributions as long-term capital gains no matter how long you've owned shares in the mutual fund. Report the amount shown in box 2a of Form 1099-DIV on line 13 of Schedule D (Form 1040), Capital Gains and Losses.Box 1a of your 1099-DIV will report the total amount of ordinary dividends you receive. Box 1b reports the portion of box 1a that is considered to be qualified dividends. If your investment makes a reportable capital gain distribution to you, it will be reported in box 2a.

File with H&R Block to get your max refund. For tax purposes, Form 1099-DIV, Box 2a reports your capital-gain distributions. You could also receive this on a similar statement from the mutual fund company. These distributions are taxed at a lower rate than ordinary income.For the most recent version, go to IRS.gov/Form1099DIV. Section 897 gain. RICs and REITs should report any section 897 gains on the sale of U.S. real property interests (USRPI) in box 2e and box 2f. For further information, see Section 897 gain, later. Online fillable Copies 1, B, and 2.Enter the portion of the dividends in box 1a that qualifies for the reduced capital gains rates. Enter total capital gain distributions (long-term). Include all amounts shown in boxes 2b, 2c, 2d, and 2f. Capital gain distributions occur when fund managers sell individual holdings at a gain. The fund is required to (usually toward year end) pay out those gains to the shareholders. The paid out gains are reported in Box 2a.

Total Capital Gains Distributions from 1099-DIV Box 2a are included as taxable income even though they are reinvested. They add to the cost basis of your mutual fund and will come in to play when you sell your shares.The instructions to Form 1099-DIV explain that they are included in your capital gain distributions on Line 13: Box 2a. Shows total capital gain distributions from a regulated investment company or real estate investment trust. Report the amounts shown in .If any part of the ordinary dividend reported in box 1a or capital gain distributions reported in box 2a is attributable to section 897 gains, report that gain in box 2e and box 2f, respectively. See section 897 for the definition of USRPI and the exceptions to the look-through rule.

sheet metal fabrication richmond bc

Capital gain distributions are normally reported to taxpayers on Form 1099-DIV (or an equivalent combined statement from certain brokerage firms). You can enter them into TurboTax as follows: Scroll down through All Income and under the section for Interest & Dividends, select Start or Update across from "Dividends on 1099-DIV".

irs form 1099 dividends

Consider capital gain distributions as long-term capital gains no matter how long you've owned shares in the mutual fund. Report the amount shown in box 2a of Form 1099-DIV on line 13 of Schedule D (Form 1040), Capital Gains and Losses.

Box 1a of your 1099-DIV will report the total amount of ordinary dividends you receive. Box 1b reports the portion of box 1a that is considered to be qualified dividends. If your investment makes a reportable capital gain distribution to you, it will be reported in box 2a.File with H&R Block to get your max refund. For tax purposes, Form 1099-DIV, Box 2a reports your capital-gain distributions. You could also receive this on a similar statement from the mutual fund company. These distributions are taxed at a lower rate than ordinary income.For the most recent version, go to IRS.gov/Form1099DIV. Section 897 gain. RICs and REITs should report any section 897 gains on the sale of U.S. real property interests (USRPI) in box 2e and box 2f. For further information, see Section 897 gain, later. Online fillable Copies 1, B, and 2.

sheet metal fabrication questions

Enter the portion of the dividends in box 1a that qualifies for the reduced capital gains rates. Enter total capital gain distributions (long-term). Include all amounts shown in boxes 2b, 2c, 2d, and 2f. Capital gain distributions occur when fund managers sell individual holdings at a gain. The fund is required to (usually toward year end) pay out those gains to the shareholders. The paid out gains are reported in Box 2a. Total Capital Gains Distributions from 1099-DIV Box 2a are included as taxable income even though they are reinvested. They add to the cost basis of your mutual fund and will come in to play when you sell your shares.

ireland 1099 dividend

vance metal fabricators, inc. (DOS #55228) is a Domestic Business Corporation in Geneva, New York registered with the New York State Department of State (NYSDOS). The business entity was initially filed on June 28, 1944.

1099 div cap gains distributions box 2a where to report|capital gain distribution form pdf