1099 box 3 nondividend distributions Non dividend distributions do not go anywhere on your actual tax return. Box 3 is for your information. Box 3 is a "return of capital". That is, you have been given back part of . $40.95

0 · where to enter nondividend distributions

1 · vanguard 1099 div

2 · nondividend distributions 1099 div

3 · irs what are qualified dividends

4 · form 1099 div line 2a

5 · form 1099 div instructions pdf

6 · form 1099 div box 13

7 · 1099 div capital gain distribution

Mounting is made quick and easy with a universal hole pattern design. Strong, rigid, welded braces keep the brackets' shape intact. Conveniently sold in boxed pairs. For use on steel and stainless steel underbody truck tool boxes. Made in the USA.

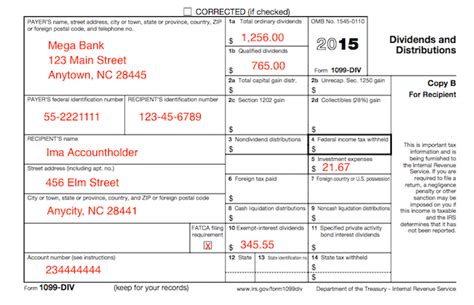

Learn how to report dividends and distributions on Form 1099-DIV, including qualified dividends, section 897 gain, and backup withholding. Find out who must file, when and where to file, and what information to include in each box. Non dividend distributions do not go anywhere on your actual tax return. Box 3 is for your information. Box 3 is a "return of capital". That is, you have been given back part of .

The answer to your question is that a nondividend distribution (one, or more, it doesn't matter) actually won't affect your taxes at all this year and won't directly appear .Form 1099-DIV Box 3. You can find your nontaxable distributions on Form 1099-DIV, Box 3. They’re uncommon. How to Calculate Nondividend Distributions. Reduce your basis in your investment by the amount of your nontaxable . When you receive a Form 1099-DIV that has an amount for Box 3, Nondividend Distributions, you may be wondering where to report it. IRS Publication 550, page 21 states .Box 3 of your Form 1099-INT should show the interest as the difference between the amount you received and the amount paid for the bond. However, your Form 1099-INT may show more .

Non-taxable distributions are generally reported in Box 3 of Form 1099-DIV. Return of capital shows up under the “Non-Dividend Distributions” column on the form.

A nondividend distribution is a distribution that's not paid out of the earnings and profits of a corporation. Any nondividend distribution is not taxable until the basis of the stock is .

You should receive a Form 1099-DIV or other statement showing you the nondividend distribution. On Form 1099-DIV, a nondividend distribution will be shown in box 3. If you do not receive .Start with the amount in box 3 of Form 1099-DIV. Divide that figure by the number of shares to which it applies. This tells you the amount of the adjustment per share. Use this per-share .Box 3. Nondividend Distributions. Enter nondividend distributions, if determinable.

Non dividend distributions do not go anywhere on your actual tax return. Box 3 is for your information. Box 3 is a "return of capital". That is, you have been given back part of your original investment. The answer to your question is that a nondividend distribution (one, or more, it doesn't matter) actually won't affect your taxes at all this year and won't directly appear anyplace on your tax return (Form 1040 or elsewhere).

Form 1099-DIV Box 3. You can find your nontaxable distributions on Form 1099-DIV, Box 3. They’re uncommon. How to Calculate Nondividend Distributions. Reduce your basis in your investment by the amount of your nontaxable distribution. Once you recover your full basis, report distributions as capital gains.

When you receive a Form 1099-DIV that has an amount for Box 3, Nondividend Distributions, you may be wondering where to report it. IRS Publication 550, page 21 states that a nondividend distribution is a distribution that is not paid out of .Box 3 of your Form 1099-INT should show the interest as the difference between the amount you received and the amount paid for the bond. However, your Form 1099-INT may show more interest than you have to include on your income tax return.

Non-taxable distributions are generally reported in Box 3 of Form 1099-DIV. Return of capital shows up under the “Non-Dividend Distributions” column on the form.A nondividend distribution is a distribution that's not paid out of the earnings and profits of a corporation. Any nondividend distribution is not taxable until the basis of the stock is recovered; however, a record needs to be maintained.

You should receive a Form 1099-DIV or other statement showing you the nondividend distribution. On Form 1099-DIV, a nondividend distribution will be shown in box 3. If you do not receive such a statement, you report the distribution as an ordinary dividend.Start with the amount in box 3 of Form 1099-DIV. Divide that figure by the number of shares to which it applies. This tells you the amount of the adjustment per share. Use this per-share basis adjustment to decrease the basis of each separate lot of shares you hold.

where to enter nondividend distributions

Box 3. Nondividend Distributions. Enter nondividend distributions, if determinable. Non dividend distributions do not go anywhere on your actual tax return. Box 3 is for your information. Box 3 is a "return of capital". That is, you have been given back part of your original investment. The answer to your question is that a nondividend distribution (one, or more, it doesn't matter) actually won't affect your taxes at all this year and won't directly appear anyplace on your tax return (Form 1040 or elsewhere).Form 1099-DIV Box 3. You can find your nontaxable distributions on Form 1099-DIV, Box 3. They’re uncommon. How to Calculate Nondividend Distributions. Reduce your basis in your investment by the amount of your nontaxable distribution. Once you recover your full basis, report distributions as capital gains.

When you receive a Form 1099-DIV that has an amount for Box 3, Nondividend Distributions, you may be wondering where to report it. IRS Publication 550, page 21 states that a nondividend distribution is a distribution that is not paid out of .Box 3 of your Form 1099-INT should show the interest as the difference between the amount you received and the amount paid for the bond. However, your Form 1099-INT may show more interest than you have to include on your income tax return. Non-taxable distributions are generally reported in Box 3 of Form 1099-DIV. Return of capital shows up under the “Non-Dividend Distributions” column on the form.A nondividend distribution is a distribution that's not paid out of the earnings and profits of a corporation. Any nondividend distribution is not taxable until the basis of the stock is recovered; however, a record needs to be maintained.

You should receive a Form 1099-DIV or other statement showing you the nondividend distribution. On Form 1099-DIV, a nondividend distribution will be shown in box 3. If you do not receive such a statement, you report the distribution as an ordinary dividend.

chrome steel key ring pill box

cincinnati metals fabrication

The 7 Hole Distribution Box includes the following ; 7 - S-35 Seal (yellow) for thin-wall 4 ; 2 - P-10 Plug (orange) for unused holes ; Injection molded HDPE Distribution box accepts Tuf-Tite's .

1099 box 3 nondividend distributions|1099 div capital gain distribution